From Cost-Plus to Value-Based – rethinking how you set prices

Pricing Fundamentals Mini Lessons #1

TL;DR

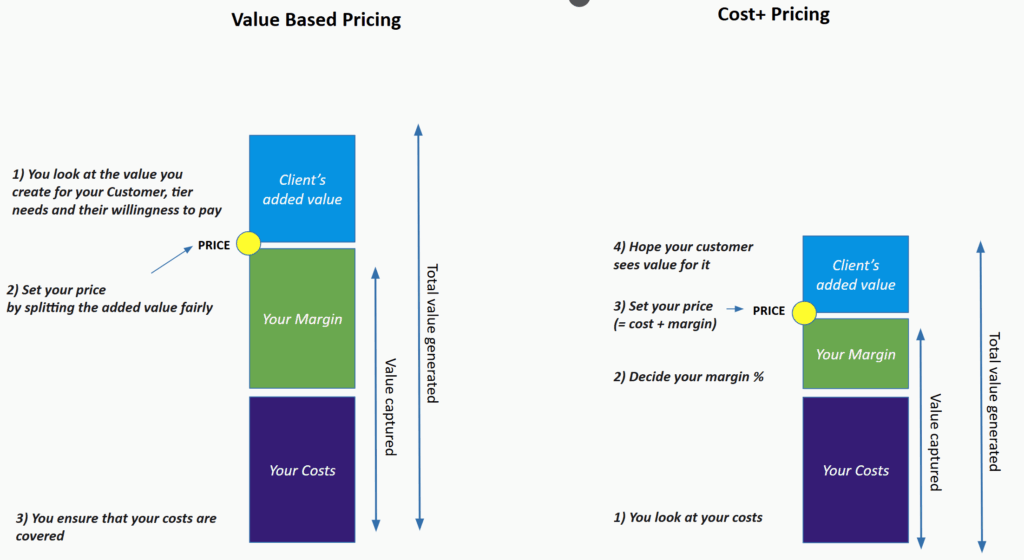

If you’re still pricing by adding a margin to your costs, you’re leaving money on the table. Value-based pricing starts with what your customer gains — not what you spend.

Here is the content of this Mini Class

- What you need to know about Value Based Pricing

- Real world examples

- How to put Value Based Pricing in place in practice

🔍 What You Need to Know

Cost-plus pricing is like comfort food for pricing teams: familiar, safe, and easy to justify. It starts from your internal metrics:

“What does it cost us to deliver?” → “Add margin” → “That’s our price.”

Example:

- Your costs to build a tool are 10 €

- You want to make a 30% margin

- You decide to sell at 13€

It works if you’re in simple manufacturing or if you’re building a commodity. But if you’re building, selling, or leading a modern product, especially in SaaS or services, this logic is deeply flawed.

Here’s why:

- It hides your upside. Cost-plus sets a ceiling on your price that’s completely disconnected from the value you create. If your product saves a customer €10,000 a year but costs you €1,000 to deliver, and you add a 30% margin — you’re leaving massive value on the table.

- It ignores customer perception. Pricing is not about fairness to your spreadsheet. It’s about fairness to their outcome. Customers evaluate whether something is “worth it” based on the value they expect to receive — not your operating expenses.

- It discourages innovation. When you tie price too tightly to cost, you limit your team’s creativity in delivering more valuable outcomes. Think about it: If your only lever is cutting costs to improve margins, you risk becoming a commodity.

- It reinforces misalignment. Product, sales, and leadership often interpret cost-plus pricing as “unquestionable math.” But that math rarely reflects reality — especially if you haven’t nailed variable vs. fixed costs, or underestimated your CAC, onboarding, or support.

- The way you calculate your costs is most likely wrong anyway. More about this in one of the following lessons

In contrast, value-based pricing flips the lens: it starts outside the company, with the customer.

Instead of “How much margin do we want?” You ask:

- “What’s the total value we’re unlocking for this customer?”

- “What’s the business impact of our solution?”

- “What would they pay to solve this problem another way?

It’s a mindset shift:

You move from “How do we cover our costs?” to “How do we claim a fair share of the value we create?”

Here’s what that unlocks:

- You can charge more when the customer value is higher (e.g., enterprise customers, complex integrations, measurable ROI).

- You build a tighter link between pricing and positioning — communicating value becomes easier and more compelling.

- You stop obsessing over “what the competition is charging” or how much bulding this product is costing to you, and you and start focusing on why customers choose you in the first place.

And importantly, value-based pricing makes your pricing conversations easier. Instead of awkwardly defending a number, you can show how the price maps directly to the outcomes they’ll get, often using their own numbers.

Value-based pricing isn’t a luxury for premium brands. It’s the most honest way to price if you’re serious about building trust, impact, and long-term customer success.

🧰 Real-World Examples

Example 1: Example: Michelin Fuel-Efficient Truck Tires

Context:

Michelin developed a new line of premium tires for long-haul trucks that significantly reduced rolling resistance. These tires helped fleets save between 2% and 4% in fuel consumption, which could translate into €2,000–€4,000 in annual fuel savings per truck.

Original Pricing Thinking:

Standard pricing based on cost-plus would suggest a modest premium — maybe €50–100 more than regular tires — based on better materials and R&D.

Value-Based Pricing Insight:

Instead of pricing based on production cost, Michelin looked at the value to the customer:

A fleet of 100 trucks could save €200,000–400,000 per year in fuel alone.

Even a price premium of €500–700 per tire was a bargain from the customer’s perspective, with ROI realized in just a few months.

Outcome:

Michelin confidently priced the tires much higher than cost-based competitors, but customers were still willing to pay, because the economic value delivered far exceeded the price.

→ Same product. Better pricing. Bigger perceived value.

( This is how Michelin explains this https://business.michelinman.com/blog/articles/how-fuel-efficient-tires-impact-fleet-costs )

Example 2: HubSpot’s CRM Upgrade

In 2021, HubSpot introduced a set of advanced sales and marketing automation features in their Professional and Enterprise plans. Internally, these features didn’t cost significantly more to deliver than the free or Starter tier; the infrastructure was already in place and development costs were spread over hundreds of thousands of customers

But the perceived value for sales teams was dramatically higher: workflow automation, lead scoring, advanced reporting, all tools that directly impacted conversion rates and team efficiency.

Rather than price it as a “small step up,” HubSpot leaned into value-based pricing:

- The Starter plan was around $20/month

- The Professional plan jumped to $800/month

The price delta wasn’t driven by cost, but by the value of outcomes delivered — better leads, faster close rates, more revenue.

✅ Putting This in Practice: How to Start Today

- List Your Value Drivers

What are the tangible benefits your product delivers? Saved time, better conversion, reduced churn, peace of mind? - Quantify the Value

Estimate the financial impact for the customer. (e.g., “3 hours saved per week at €40/hour = €120 saved”) - Change Your Anchor

Stop starting from cost. Instead, start from value delivered and ask: “What’s a fair share of this value to capture?” - Test Willingness to Pay

Ask your best-fit customers: “At what price would this still feel like a great deal?” - Adjust the Narrative: In sales or marketing, shift the focus from your cost to their outcome. Instead of: “It costs us X to build…” → Say: “You’ll save X or gain Y from using this.”

Now, even if this sounds complex at first glance, in the next lessons, we’ll look at pragmatic ways to define and quantify the value you generate, so that you’ll be able to sell your products and services on the basis of the value they produce to your customers rather than their cost to you.

📘 Want to Go Deeper?

This is just one of the many pricing blind spots we tackle in Pricing Fundamentals for Product Leaders, our hands-on class designed for product and business leaders who want to stop guessing and start pricing with confidence.

Over 4 weeks, you’ll learn how to:

- Identify and quantify the real value your product creates

- Craft a pricing strategy that supports your business goals

- Master the tools and mindsets to align your team around pricing

My name is Salva, I am a product exec and Senior Partner at Reasonable Product, a boutique Product Advisory Firm.

I write about product pricing, e-commerce/marketplaces, subscription models, and modern product organizations. I mainly engage and work in tech products, including SaaS, Marketplaces, and IoT (Hardware + Software).

My superpower is to move between ambiguity (as in creativity, innovation, opportunity, and ‘thinking out of the box’) and structure (as in ‘getting things done’ and getting real impact).

I am firmly convinced that you can help others only if you have lived the same challenges: I have been lucky enough to practice product leadership in companies of different sizes and with different product maturity. Doing product right is hard: I felt the pain myself and developed my methods to get to efficient product teams that produce meaningful work.