Lifetime Deals for Digital Products: genius or gamble?

Among various pricing models, lifetime pricing or lifetime deals have gained significant attention. This article looks into the concept of lifetime pricing, its advantages, disadvantages, and when it might be the right choice for your business.

Long story short – more often than not, they’re not a sound long-term product strategy, particularly in the digital realm. However, we will see in detail when lifetime deals make sense for the business; this includes launch campaigns, leveraging them as an early operational simplification tool, or as a basis for an add-on pricing strategy.

We will also see how the idea of lifetime deals is not new and analyze the biggest epic fail of lifetime subscriptions: the famous American Airlines AAirpass has been costing to Amerian Airlines millions since 1981 until… today!

In the world of “too good to be true” pricing models, remember the common refrain “If the product is free, then you are the product.”?

Similarly, with lifetime deals, one might say, “A lifetime deal is only as long as the product’s life.” Indeed, more often than not, the life of a non-viable product will be short.

What is Lifetime Pricing (or Lifetime Deals)?

Lifetime pricing refers to offering a product or service for a one-time fee, granting the customer access to the products throughout its entire lifespan. Unlike traditional subscription models that charge users periodically, lifetime deals require a single upfront payment, at least for the main component of the product itself. But wait, isn’t this the definition of a product in the first place?

Not too long ago, with hardware sales or “downloadable” products, buying a tool or software and owning it for life was the norm. Then, the subscription model emerged, pioneered by companies like Salesforce and Netflix in the late 1990s. They were considered the pioneers of recurring revenue and subscription pricing for digital products—and it was deemed revolutionary.

The subscription model revolutionized the way digital products are priced and sold, superseding the legacy ‘buy and forget’ software business for several reasons.

For businesses, subscription models:

- Match well with the “continuous evolution” lifecycle of software and its related expenses.

- Reduce the dependency on new customer acquisitions, providing a more stable revenue stream.

For customers:

- Lower the initial investment.

- Incentivize businesses to provide long-term value, as well as updates, bug fixing and so on.

Today, subscriptions are still seen as the holy grail for digital companies, with KPIs like ARR (Annual Recurring Revenue) being top metrics for many of them. This is for a good reason: subscription models align the interests of both the customer—who wants a product that continues to work and evolve—with those of the vendor—who needs a recurring revenue stream to support development and customer support.

Why Reconsider Lifetime Deals Now?

Despite the strong case for subscription models, “buy and forget” software deals were the norm up until about a decade ago and an increasing number of companies is starting to propose “pay once, use forever” deals again.

But there is even more: the “legacy” versions of these deals referred to a product that was paid once, acquired once, used forever and updated… never; For instance, purchasing Microsoft Word and using it from 1995 to 2005 was typical.

The new era of lifetime deals goes one step further (at least on paper). Many modern lifetime software and deals like in every good SaaSproduct, come with long-term evolutions and updates, unlike older sales models that only offered a static software version (e.g., MS Word 95).

What levers are these deals activating in the customers, who seemed to be so eager to switch to subscriptions when they first appeared?

- Subscription Fatigue: As covered in detail in another article, the accumulation of monthly software bills can lead to “subscription fatigue.” A “pay once, use forever” model may sound refreshing to those weary of ongoing fees.

- Ownership and Lock-in Concerns: The desire for ownership was one of the initial barriers to subscription models. Think about the transition from physical music collections to Spotify’s streaming model. Many of us have been used to collecting CDs in their shelves and just “possess” the music (or, at least, the physical support). While many have adapted, lifetime models can reintroduce the satisfaction of ownership. For B2B products, this translates to reduced fear of “lock-in,” where customers worry about having to continually pay just to retain access to essential services.

- Predictability: Lifetime deals offer expenditure predictability—no risk of price increases—and reduce concerns about product changes that deviate from original functionality (e.g., a CRM that suddenly drops key features). This risk reduction only partially applies to connected SaaS products where only the payment model is one-off.

- Differentiation: In a market saturated with subscription models, offering a unique alternative can cut through the noise and attract attention. This can be an effective way to stand out from competitors.

Who started Lifetime deals first?

Lifetime pricing has been utilized by various companies over the years, particularly in the SaaS and digital product sectors. While pinpointing the exact “first” company to propose it is challenging, several early adopters popularized this model. Notable examples include:

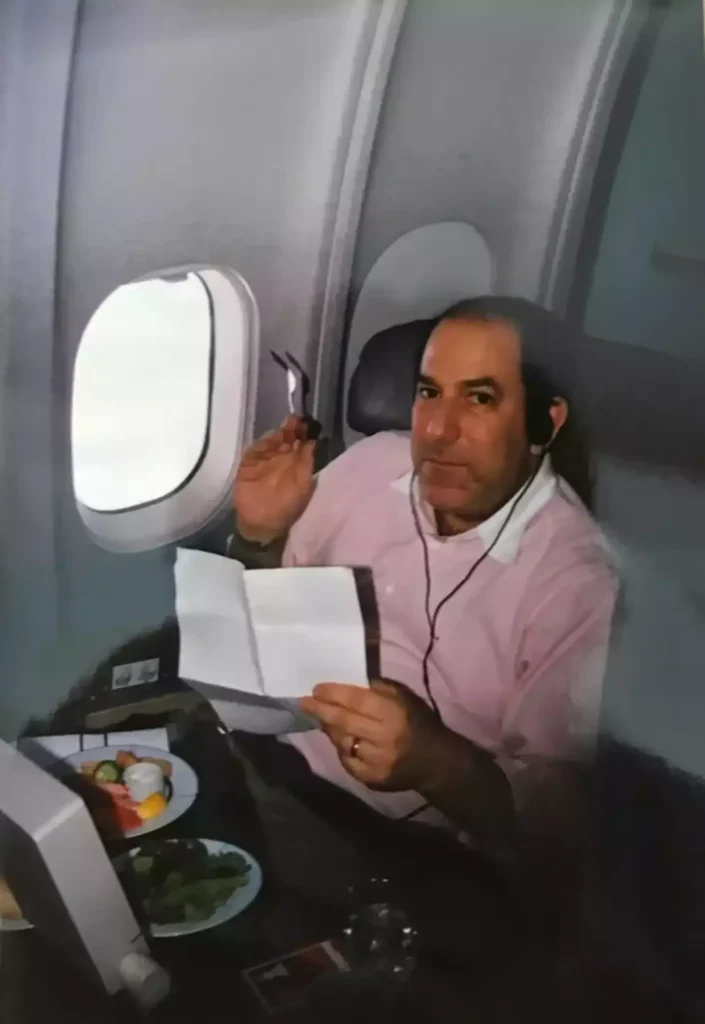

- American Airlines: We mentioned already the American Airlines AAirpass from 1981. With an initial purchase of 250’000$ worth of a lifetime pass, you could travel in first class, worldwide, unlimited, for all your life! (more about the financial implications later in this article)

- AppSumo: Founded in 2010, AppSumo played a significant role in popularizing lifetime deals by partnering with SaaS companies to offer their products at discounted, one-time payments and providing them exposure to a large audience.

- Evernote: This popular note-taking app offered a lifetime premium plan during its early years, helping them build a substantial user base quickly.

- Groove: The helpdesk software company offered lifetime deals in its early stages to generate quick revenue and user growth, which helped validate their product in the market.

- Setapp: A subscription service for Mac apps, Setapp periodically offered lifetime deals to attract users and secure a dedicated base willing to pay upfront.

- Depositphotos: This stock photo company leveraged platforms like AppSumo to offer lifetime subscriptions and attract a reliable customer base without recurring costs.

- pCloud often comes up with lifetime plans as a way to attract customers seeking long-term solutions.

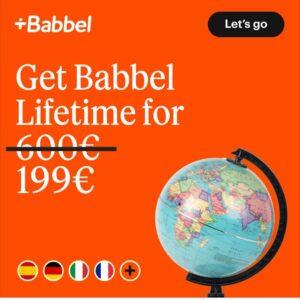

- Babbel still offers from time to time a lifelong deal at 189 EUR. And don’t let me get even started on the “70% off” discount stuff!

These companies leveraged lifetime pricing to achieve various goals such as quick cash flow generation, building a user base, and gaining market traction. But there is really more than this.

Analysis of Lifetime Deals: Viability, Desirability, and Feasibility

To tackle this complex topic in a structured manner, we will analyze it under three key pillars:

Viability – Yes, but not really.

- Immediate Revenue vs. Long-term Sustainability: Lifetime deals can create an artificial spike in revenue during the first year, providing a much-needed cash flow boost.

- Turnover: In a world (at least until some time ago) dominated by risk money and VCs, being able to show impressive numbers during the first years, was also a way to (try to get) higher valuations during investment rounds

- However, withouth proper safeguards in place, high revenues in the first year translates into fundamental sustainability challenges in the mid and long run.

We mentioned already the example of American Airlines AAirpass. While this pass was launched at the beginning of the 80s’ to mitigate a cashflow problem resulting of profund changes in the regulations at the end of the 70s. While the sale of 66 unlimited passes brought in some well needed oxygen, issuing “all you can fly” passes was a time bomb, whose effect would propagate over the years.

In particular, just two AAirpass holders, Steven Rothstein and Jacques Vroom, were costing the airline more than $1 million annually! Not only this: each flight was letting their users cumulate miles (points) that could be converted into gifts and vouchers, making the situation even worse! The impact has been so strong on American Airlines, that they’ve been fighting since to “take back” the offer and remove the benefits from their holders; this included several fights in court.

If you’re interested in knowing more about AAirpass, just google “American Airlines AAirpass” ; there is also a great article on the Guardian written by the doughter of Mr. Rothstein himself providing a very interesting point of view about why Lifetime deals don’t fly, both for businesses and their customers https://www.theguardian.com/lifeandstyle/2019/sep/19/american-airlines-aairpass-golden-ticket

- Lost Revenue: The “lost of opportunity” (eg. of selling an yealy subscription) is probably the biggest drawback and hidden cost for a company of a Lifetime deal. In the case of American Airlines, not only the lost ticket sales but the countervalue in loyalty points and the aiport taxes where an additional and out-of-pocket liability. However, in the case of products or services with a by default limited LTV (Lifetime Value) such as language classes (you’re not going to spend all your life learning that fancy language, will you?) the loss may be limited and the Lifetime deal may make more sense.

Desirability – Only at first sight

- Lifetime deals are highly attractive to customers seeking cost savings and ownership.

- Decoy – Sometimes they are unattractive on purpose, serving as decoy alternatives and enticing customers to get the traditional subscription offer instead

- Durability – But if the model is not financially viable for the business, it’s not sustainable in the long run and customers understand that they cannot depend on a service that is not financially viable

Feasibility – This one is a clear win for lifetime deals.

Operational Simplicity: Managing lifetime deals is simpler than handling recurring billing cycles. This simplicity is particularly beneficial for new startups that may not yet have the infrastructure for complex subscription management.

What’s in for the seller?

The most evident reasons for companies to move to lifetime deals are to create a short term surge in sales. But there is more than this :

- Immediate Cash Flow: Lifetime deals can provide a significant upfront cash influx, which is especially beneficial for startups needing capital to scale operations or invest in marketing.

- Customer Attraction: The appeal of a one-time payment can quickly attract a large number of customers, aiding user base growth and word-of-mouth marketing. This is especially important for companies who need to attract a critical mass first either to gain the “first mover advantage”, or to unlock specific network effects.

- Feedback Attraction: Introducing a new product with a lifetime deal can create buzz and attract early adopters who provide valuable feedback.

- Simplified Management: Without the need for managing recurring billing, administrative processes are streamlined, allowing businesses to focus more on product improvement.

- Market Penetration: In competitive markets, a lifetime deal can differentiate your product and draw users from competitors.

- Time bound value products: Think about language classes. Even if in theory you could and have paid for it, chances are that you’re not going to learn the same new language forever and your LTV (lifetime value) as a customer is limited by default. In this case, the seller is not loosing too much offering you a lifetime deal; to the contrary, they will build on your existing (lifetime) product to upsell you new languages and products.

- As a Basis for an Add-On/Upselling Strategy: Lifetime deals can serve as an entry point for customers, allowing businesses to upsell additional services or features later.

- As a Basis for a Usage based Pricing. As for the Add-On rationale, a product that is “paid for” in its base version but is also monetized through consumption may count on a “non churning” user base (constituted by lifetime deal owners), who still pay on top

By now, it should be clear that while lifetime deals are not necessarily a panacea and may carry more risks than benefits, there are specific reasons why they can be an interesting tool in your strategy. As always, understanding why you are using them, rather than blindly following industry trends, is the most critical element in your pricing strategy.

My name is Salva, I am a product exec and Senior Partner at Reasonable Product, a boutique Product Advisory Firm.

I write about product pricing, e-commerce/marketplaces, subscription models, and modern product organizations. I mainly engage and work in tech products, including SaaS, Marketplaces, and IoT (Hardware + Software).

My superpower is to move between ambiguity (as in creativity, innovation, opportunity, and ‘thinking out of the box’) and structure (as in ‘getting things done’ and getting real impact).

I am firmly convinced that you can help others only if you have lived the same challenges: I have been lucky enough to practice product leadership in companies of different sizes and with different product maturity. Doing product right is hard: I felt the pain myself and developed my methods to get to efficient product teams that produce meaningful work.